DGT Updates Service for Forgotten EFIN, Here's How to Do it

Friday, 09 February 2024

JAKARTA. The Directorate General of Taxes (DGT) has updated the service for requests related to forgotten Electronic Filing Identification Number (EFIN). Therefore, starting from 5 February 2024, the EFIN request service through social media channels Twitter or X @Kring_Pajak will be discontinued.

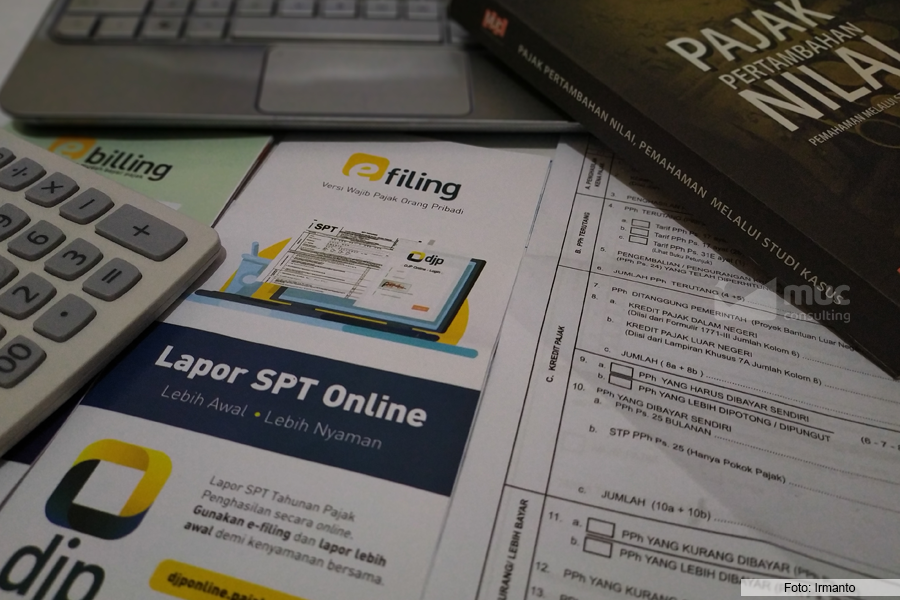

EFIN requests are commonly made by taxpayers during the period for filing the Annual Tax Return (SPT). An EFIN is required for taxpayers to be able to request password changes when accessing the e-filing application.

Based on the announcement issued by the DGT with No. PENG-3/PJ.09/2024, DGT has provided several channels for forgotten EFIN requests for both individual taxpayers and corporate taxpayers.

For individual taxpayers who wish to access the forgotten EFIN service, five service channels are available. First, through telephone number 1.500.200 which can be accessed on weekdays from 08.00-16.00 WIB.

Second, through a live chat channel available on the website www.pajak.go.id on weekdays from 08.00-16.00. Third, through electronic mail or email with the address lupa.efin@pajak.go.id. Fourth, individual taxpayers can use the M-Tax application.

Then, the fifth way is taxpayers can directly visit the Tax Office (KPP) or the Office for Tax Counseling, Consulting, and Services (KP2KP)

Meanwhile, corporate taxpayers have three services available to submit forgotten EFIN requests. Namely, through telephone 1.500.200 and live chat accessible on weekdays from 08.00-16.00 WIB and can directly visit the KPP or KP2KP registered on weekdays from 08.00-16.00 local time.

How to Access Forgotten EFIN Email

The following are the steps to use the forgotten EFIN service through the email channel for individual taxpayers. First, taxpayers can send a forgotten EFIN request to the email lupa.efin@pajak.go.id using the registered individual taxpayer's email address, with the email subject: LUPA EFIN.

Then, in the body of the email, it must include the Taxpayer Identification Number (Tax ID Number), the taxpayer's name, registered address, registered email address, and registered telephone or mobile number.

In addition, taxpayers must also submit a statement or affirmation as follows: "I declare that I am a taxpayer who has the right to access the requested information. I am willing to bear legal consequences under applicable legal provisions if, in the future, I am proven not to be the party with the right.” (ASP/KEN)