Russian Invasion, Inflation, and Dilemma of Booming Oil Prices

MUC Tax Research Institute

|

Friday, 27 May 2022

Inflation is a current problem of the global community, which at the same time is still struggling to be free from the Corona catastrophe. The energy crisis, supply chain disruptions, and Russia's invasion of Ukraine are a series of new problems that have caused price to surge for goods and services, and disrupted global economic stability.

The Russian-Ukrainian armed conflict is not only a matter of geopolitics but there are also economic interests that could trigger a new crisis. As the world's largest supplier of gas and wheat to the world—especially Europe, Russia plays a vital role in determining the direction of global political and economic policies. As a result, the Kremlin's "vigilantism" against Ukraine and the "half-hearted" counterattack of the United States and its NATO allies (the economic embargo) must be paid dearly by the entire global community.

The Organisation for Economic Co-operation and Development (OECD) expects the Russia-Ukraine war to increase inflation by 2.47% until next year. The conflict between the two post-Soviet states is also predicted to erode world economic growth by more than 1.08%. The worst economic downturn will probably occur in Europe and the United States, which have the potential to shrink at 1.04% and 0.88%, respectively.

Moreover, Morgan Stanley predicts that the global economy will likely only grow at 2.9% in 2022 or less than half of last year's 6.2% growth. This is lower than the forecast of the International Monetary Fund (IMF), which recently cut its projection for world economic growth from 4.4% to 3.6%.

The United States, as the country with the largest economy in the world, is now facing the threat of the highest inflation in the last four decades. Amid the economic recovery efforts, the country's consumer price level soared to the level of 8.5% in March 2022 and forced the Central Bank or The Federal Reserve (The Fed) to raise its benchmark interest rate by 75 basis points during the last three months. The Fed still opens up the possibility of a rate hike in the next meeting of the Central Bank's Board of Governors considering that the inflation remains above 8%.

Similar conditions prevailed in the UK, with the inflation reaching its highest level in 40 years (9% in April 2022). To mitigate this, the Bank of England raised its benchmark interest rate in the last four board of governors meetings in a row, from the lowest level during the pandemic of 0.1% to a 13-year high of 1%.

The tight monetary policy of the US and the UK could absorb the capital flows from developing countries, including Indonesia. The most obvious indications of capital outflows are depressed stock prices and bonds, along with the weakening of the rupiah exchange rate in recent times.

The liquidity crisis in the money market is further aggravated by supply chain disruptions and rising inflation. In Indonesia, this is reflected by the scarcity and high price of cooking oil, as well as the rise in non-subsidized fuel oil at a time when public demand was increasing prior to Eid.

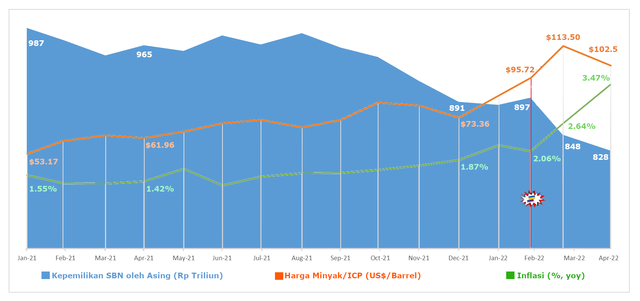

Monthly inflation, which was used to be around 1% (year-over-year), suddenly jumped to 3.47% in April 2022. The indicator of the increase in the price of goods and services has surpassed the target of 3% in the 2022 State Budget.

In terms of policy, the increase in the Value Added Tax (VAT) rate from 10% to 11% as of 1 April 2022 also contributed to the increase in the prices of goods and services. This condition can be worse if the government adjusts the price of subsidized fuel and gas. The combination of these factors are concerned to further disrupt Indonesia's economic recovery after the recession two years ago.

In March, IMF also revised Indonesia's 2022 economic outlook, from the previous projection of 5.6% to 5.4%. Further, the World Bank also changed its economic forecast for Indonesia in 2022 from 5.2% to 5.1%. The same was done by Bank Indonesia, which lowered the projection range for national economic growth from the previous of 4.7%-5.5% to 4.5%-5.3%.

So far, only the government remains optimistic that Indonesia's Gross Domestic Product (GDP) will grow at 4.8%-5.5% in 2022, given that the economic activity in the first quarter and during the Eid holiday. However, this optimism is unlikely to last long considering that the Minister of Finance has begun to roll out the discourse on revising the 2022 State Budget.

Fiscal Dilemma

The mass revisions to the GDP projection constitute the tremendous economic pressure amid surging inflation and the increasingly heated escalation of war in the Crimean Peninsula. This global dynamic also has the potential to disrupt Indonesia's fiscal health, which has been heavily dependent on foreign capital injections and is vulnerable to oil price fluctuations.

The Ministry of Finance recorded that the state bonds holding by foreign investors as of April 2022 amounting to IDR827.85 trillion has eroded by IDR68.8 trillion during the two months of Russia's invasion of Ukraine. Compared to the position in April 2021, the amount of foreign capital withdrawn from the government bond market in the past year reached IDR136.75 trillion. This trend is likely to continue following the tight monetary policies adopted by the US and a number of developed countries.

Meanwhile, booming oil prices are like two sides of a coin, it can be a blessing or a problem for Indonesia's finances. In the 2022 State Budget, the government and the house of representative made an assumption of Indonesian crude price (ICP) at US$63 per barrel with a production target (lifting) of 703,000 barrels per day (bpd). Meanwhile, the realization of ICP since the beginning of the year has been above US$85 per barrel and has even reached the level of US$103.5 per barrel after the Russian bombardment of Ukraine. In terms of oil production, Special Task Force for Upstream Oil and Gas Business Activities recorded its realization in the first quarter of 2022 at 611,700 bpd.

The trend of rising oil prices has actually occurred since last year. This global phenomenon has indirectly become a blessing in disguise for state revenues (tax and non-tax), which reached 115% of the target of IDR1,743.6 trillion in the 2021 State Budget. A rare achievement that brings us back to 2008, when the oil price boom boosted state revenues to reach 109% of the Revised State Budget target.

Unfortunately, Indonesia's status as a net-importer makes the income from the sale of crude oil just come and go. Tax payments and Non-Tax Revenue for oil and gas are frequently disproportionate to the needs of the much larger state budget. As a result, the state budget deficit is at risk of getting bigger when the country needs huge financing to tackle the pandemic, restore the economy, as well as funding the construction of a new capital city.

In 2008, for instance, even though the state revenue target was achieved, in terms of government spending—especially subsidy spending—a significant increase occurred compared to the previous year's realization. Subsidy spending in 2008 jumped at 83.27% to IDR275.3 trillion from IDR150.2 trillion in 2007. Subsidies pushed the realization of total government spending to increase by more than 30% in a year. Meanwhile, state financing has almost doubled (98%) from the previous year.

In 2021, subsidy increases were generally not as burdensome as in 2008, thanks to more targeted and specific subsidy policy reforms since 2015. Although the energy subsidies increased by 15.6% in 2021, overall subsidy spending (including non-energy) declined by 8.7%.

Based on the Ministry of Finance's preliminary calculation, the realization of government spending in 2021 only increased by IDR10.8 trillion or 0.4% compared to that in the previous year, which amounted to IDR2,739.2 trillion.

Beware of Fuel Price

With a better State Budget, ideally, fiscal credibility can be maintained. However, as the political year approaches, the government must be careful in responding to the upward trend in commodity prices, especially oil and gas. The unstoppable spike in cooking oil prices should be a valuable lesson.

We are being overshadowed by the threat of high inflation. We do not wish that the price increase of cooking oil be followed by an increase in the price of subsidized fuel and LPG.. All these commodities are closely related to people's livelihoods.

History has proven that economic slowdowns and inflation spikes coupled with a shortage of supplies of basic goods and energy always correlate with the decline in people's welfare. The riots in Sri Lanka are a recent example of a country's poor economic governance, as was the 1997 monetary crisis that brought down Indonesia's New Order.

*Authors: Agust Supriadi & Asep M. Zatnika (Researcher)

**Disclaimer: This article is the author's opinion and does not reflect the attitude of the institution in which the author works.

***Article published on umparan.com (25 May 2022)

Kumparan.com

Disclaimer! This article is a personal opinion and does not reflect the policies of the institution where the author works.