Three Former Director Generals of Taxes Talk About State Revenue Agency

Asep Munazat

|

Wednesday, 16 October 2024

JAKARTA. The plan to establish a State Revenue Agency (BPN) by President-elect Prabowo Subianto is considered the right policy to boost state revenue.

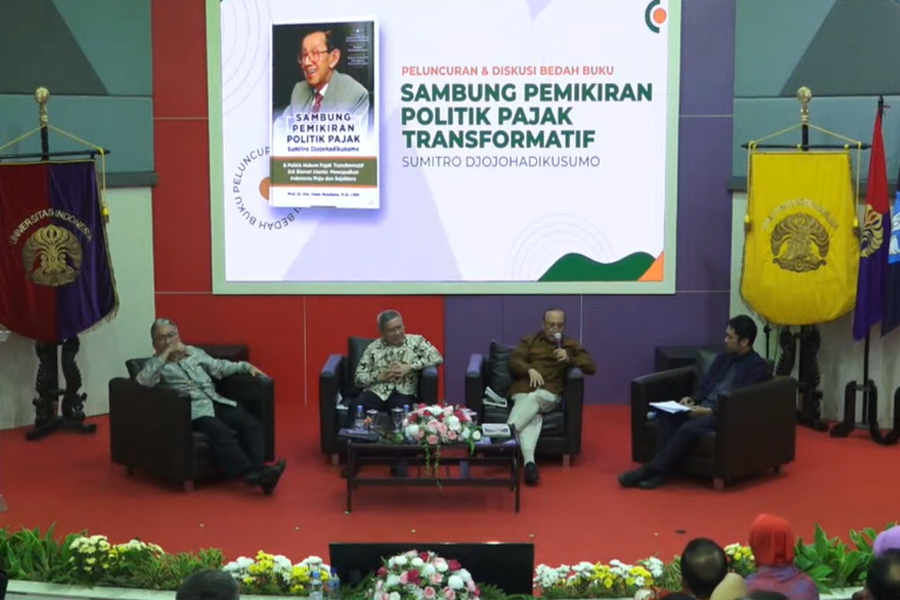

This was conveyed by three former Directors General of Taxes, namely Fuad Bawazier, Machfud Sidik, and Fuad Rahmany in a discussion and book review of "Sambung Pemikiran Politik Pajak Sumitro Djojohadikusumo" written by Prof. Dr. Haula Rosdiana, M.Si on Tuesday (15/10).

Fuad Bawazier, who was the Director General of Taxes for the 1993-1998 period, believes that the separation of the Directorate General of Taxes from the Ministry of Finance can strengthen the government's efforts to boost tax revenue.

This is crucial because the development of tax revenue has not been optimal, which is characterized by the low tax ratio, which is the ratio between tax revenue and Gross Domestic Product (GDP).

Separation of Regulator and Tax Executor Functions

In fact, according to Fuad, the BPN that will be created by the new government is better in the form of a Ministry. "If it is a ministry, there will be a ministry that takes care of revenue and one that takes care of spending," said Fuad Bawazier.

Meanwhile, Mahfud Sidik, Director General of Taxes for the 200-2001 period, revealed that in several developed countries, the tax authority is independent as a Semi-Autonomous Revenue Agency.

Comprehensive Research Needed

However, Mahfud reminded that the establishment of a semi-independent tax authority must be based on comprehensive and in-depth research so that the results are optimal.

Then, according to Fuad Rahmany, Director General of Taxes 2011-2015, the establishment of BPN is urgent, especially related to the management of human resources (HR) within the DGT.

According to him, DGT needs to have more authority in conducting recruitment and dismissal. So far, both employee addition and dismissal must refer to the Law (UU) on State Civil Apparatus (ASN).

He gave an example, when dismissing or transferring DGT employees due to performance below the Key Performance Index (KPI), it cannot be done because it must refer to the ASN Law.

In recruiting employees, DGT can also use the principle of meritocracy, according to the expertise and competence required. For example, to fulfill the needs of employees with competence in technology and information. (ASP)