By End of May 2024, Tax Revenue Reaches Just 38.23% of Target

Thursday, 27 June 2024

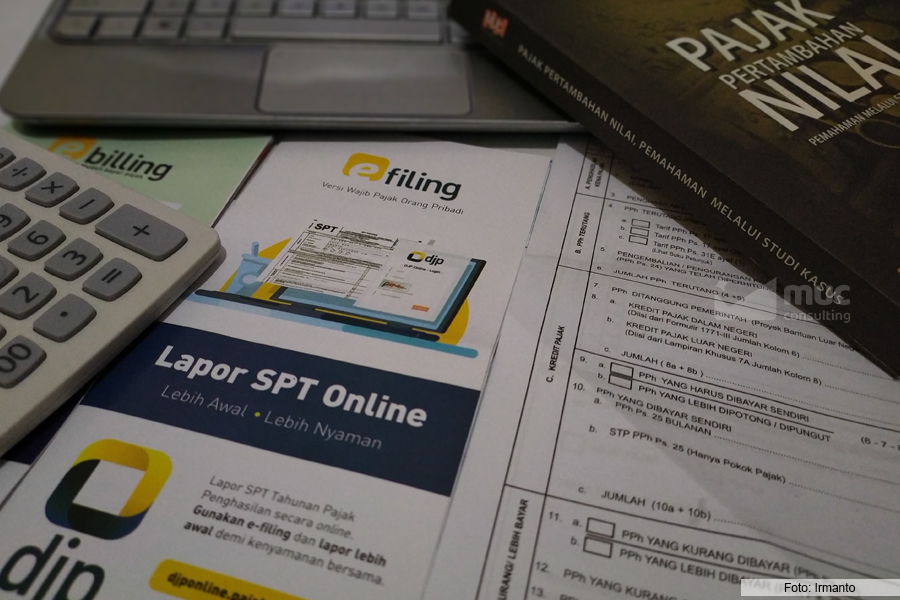

JAKARTA. Indonesia's tax revenue realization until the end of May 2024 was recorded at IDR 760.38 trillion, or only 38.23% of the target set in the 2024 State Budget (APBN).

As an illustration, in the same period in the last two years, namely 2023 and 2022, the revenue achievements were 48.33% and 47.51% of the target, respectively. For information, in both years, tax revenue until the end of the year was 102.80% and 115.61% of the target.

In detail, tax revenue as of May 2024 consists of non-oil and gas income tax revenue of IDR 443.72 trillion or 41.73% of the target. Then, oil and gas income tax revenue was IDR 29.31 trillion or 38.38% of the target.

Furthermore, Value Added Tax and Sales Tax on Luxury Goods (VAT and STLG) were recorded at IDR 282.34 trillion or 34.80% of the target. Finally, the revenue of Land and Building Tax (L&B tax) and Other Taxes amounted to IDR 5 trillion or 13.26% of the target.

Impact of Commodity Prices

According to the government, the performance of non-oil and gas income tax revenue was affected by the impact of weakening commodity prices that occurred last year, leading to decreased corporate profits, especially in commodity-related sectors.

Thus, not only is the achievement still low, but non-oil and gas income tax revenue growth has also contracted. Meanwhile, VAT and STLG revenues are influenced by economic performance, which according to the government is in a good trend.

Upon further examination, several types of taxes also contracted. For instance, Corporate Income Tax experienced a negative growth of 35.7%, Domestic VAT contracted by 9.1%, and Import VAT contracted by 0.1%.

The decline in domestic VAT revenue is considered to have occurred due to increased restitution in the processing industry, trade and mining. (ASP/KEN)