PMK 172/2023 Changes the Threshold Reference for Consolidated Gross Revenue Related to CbCR

Isna Nurlaeli

|

Thursday, 25 January 2024

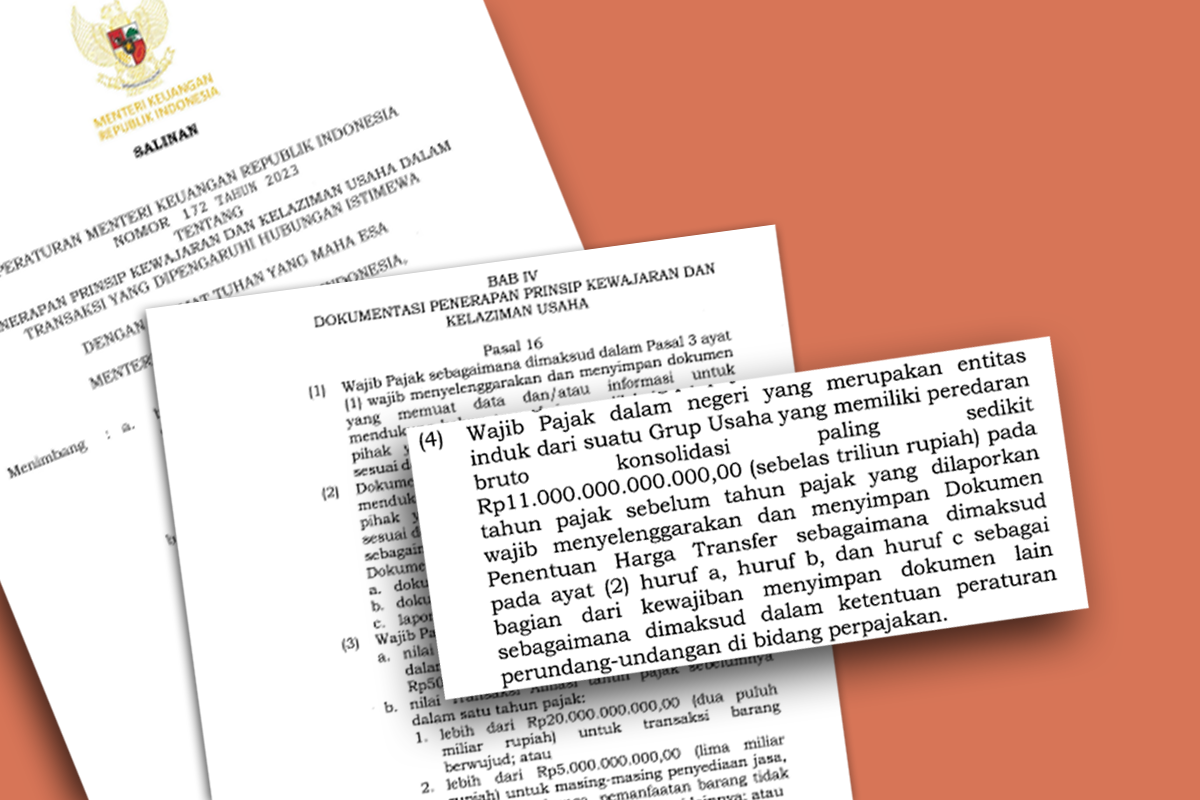

Through the Minister of Finance Regulation (PMK) Number 172 of 2023, the reference for determining the threshold of the consolidated gross revenue of business groups for determining the obligation to prepare and report Country by Country Report (CbCR) is amended.

The following is the provision of Article 16 paragraph (4) of PMK 172/2023 which regulates this matter.

Domestic taxpayers who are the parent entity of a Business Group having consolidated gross revenue of at least IDR11,000,000,000,000.00 (eleven trillion rupiahs) in the fiscal year preceding the reported fiscal year are obliged to organize and keep the Transfer Pricing Document as referred to in paragraph (2) letter a, letter b, and letter c as part of the obligation to keep other documents as referred to in the provisions of laws and regulations in the field of taxation.

Previously, as stated in Article 2 paragraph (3) of MoF Regulation 213 Year 2016, the reference used was the gross revenue value in the relevant tax year. Now, it changes to the gross revenue value in the tax year before the tax year in which the CbCR is reported.

Read: Examining the Deadline of TP Doc Availability in PMK 172/2023

CbCR is one of the transfer pricing documents (TP Doc) that must be prepared by an entity in a business group to document its transfer pricing determination.

In Alignment with the Ex-Ante Approach

The change in the reference for determining the consolidated gross revenue threshold is in line with the affirmation of the ex-ante approach in the preparation of the TP Doc in accordance with Article 17 paragraph (1) of PMK 172/2023. With the ex-ante approach, the preparation of the TP Doc must be based on the data and information available at the time of the transaction.

For information, the TP Doc is a report containing data or information to ensure that transactions conducted with related parties are following the Arm's Length Principles (PKKU). In addition to CbCR, TP Doc also consists of a master file and a local file.

Read: PMK 172 Year 2023 Reinforces Ex-Ante Provisions in Transfer Pricing Regulation

Threshold Value Unchanged

Meanwhile, the parent entity of a business group that is required to organize and store TP Doc, including CbCR, must have a consolidated gross revenue of at least IDR11 trillion. For parent entities that are foreign tax subjects, the threshold value of gross revenue is at least EUR750 million.

The limit of gross revenue value stipulated in Article 16 paragraph (4) of PMK 172/2023 is still the same as the previous provisions, namely Article 2 paragraph (3) of PMK 213 Year 2016 (PMK 213/2016) and Article 2 paragraph (1) letter a and Article 3 paragraph (1) letter d of the Director General of Taxes Regulation (PER) Number 29 Year 2017.

Obligation to Submit CbCR Notification

In addition to the obligation to prepare and report CbCR, entities that meet the criteria are also required to report CbCR notification to the Directorate General of Taxes (DGT) following Article 23 paragraph (1) and (2) of PMK 172/2023.

CbCR notification aims to state whether the Taxpayer has the obligation to submit CbCR or not. The submission of CbCR notification is also in line with the consensus of Base Erosion and Profit Shifting Action (BEPS Action) 13 regarding Country-by-Country Reporting.

In general, CbCR notification contains statements regarding:

a. identification of the domestic taxpayer that is the parent entity;

b. identification of domestic taxpayers that are not the parent entity; and

c. statement of obligation to submit country-by-country report.

Conversion of Consolidated Gross Revenue Value

In the previous regulation, namely Article 3 paragraph (1) letter d number 1) PER-29/2017, every parent entity with foreign tax subject status that uses a functional currency other than rupiah, needs to convert its consolidated gross revenue value into Euro currency value.

In fact, the regulation explicitly stipulates that the conversion rate used to determine the consolidated gross revenue value is the exchange rate of the parent entity's functional currency on 1 January 2015.

However, PMK 172/2023 does not clearly regulate the conversion rate used in calculating consolidated gross revenue for parent entities that are foreign tax subjects. This can be seen in Article 22 paragraph (1) letter d number (1) PMK No. 172/2023 as follows.

The parent entity which is a foreign tax subject as referred to in Article 16 paragraph (5) is an entity that:

d. has a consolidated gross turnover in the tax year preceding the reported tax year of at least:

1. equivalent to €750,000,000.00 (seven hundred and fifty million Euro) based on the exchange rate of the functional currency of the parent entity if the country or jurisdiction where the parent entity is domiciled does not require the submission of reports per country; or...

The exchange rate conversion to calculate the consolidated gross turnover is only mentioned in Appendix Letter C of PMK 172/2023. The attachment exemplifies the filling of information/data in the CbCR notification for the 2023 tax year, with the exchange rate conversion used being the exchange rate as of January 1, 2023. However, there is no other explanation regarding the exchange rate used in the body of the regulation.

Thus, the lack of clear stipulation of exchange rate conversion creates legal uncertainty for taxpayers. This raises the question of whether the exchange rate conversion as of 1 January 2023, applies to subsequent tax years or whether there will be an update of the exchange rate every year for the purpose of filling the CbCR notification. (ASP/KEN)