Rules Amended, Electricity Connection Cost Below 6,600 VA Category is VAT-Free

Friday, 04 September 2020

The government changed the stipulation regarding the provision of Value Added Tax (PPN) exemption facility on imported goods, as well as delivery of certain strategic goods, by issuing Government Regulation (PP) number 48 of 2020, which is an amendment of Government Regulation number 81 of 2015.

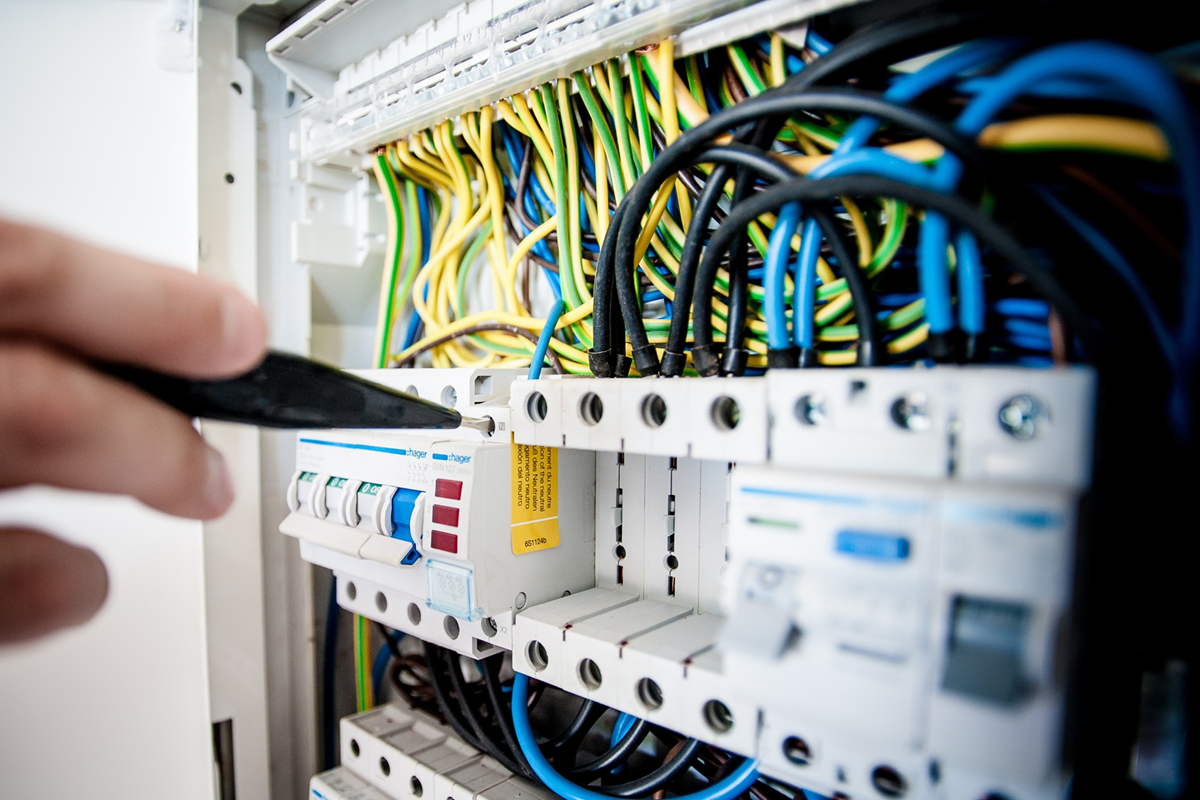

One of the changes in the regulation that took effect from 24 August 2020 is regarding the exemption of VAT on the electricity delivery. Previously, this facility was provided only for the delivery of electricity below 6,600 VA, now it includes installation and connection costs.

The amendment to this regulation was made to provide legal certainty, increase the national electrification ratio and meet the demand for efficient electricity.

In addition to changing the provision regarding electricity VAT exemption, the new government regulation also adds to the list of types of goods that are exempted from Import VAT, namely Liquid Natural Gas (LNG).

Thus, now there are 10 goods that have received import VAT exemption. Meanwhile, there are 12 goods that get VAT exemption facility upon their delivery.

Taxable Goods that are Import VAT-free

- Machinery and Electrical Equipment

- Marine Products and Fisheries

- Tanned Raw Hides and Skins

- Livestock

- Seedlings or Seeds

- Animal feed

- Fish feed

- Material for making animal and fish feed

- Silver craft raw materials

- Liquid Natural Gas

Taxable goods that are VAT-free on its delivery

- Machinery and Electrical Equipment

- Marine Products and Fisheries

- Tanned Raw Hides and Skins

- Livestock

- Seedlings or Seeds

- Animal feed

- Fish feed

- Feed Ingredient

- Silver craft raw material

- Owned Simple Flats

- Electricity below 6,600 VA category

To obtain VAT exemption facilities, VAT-Registered Persons (PKP) who import or deliver goods do not need to have a notice of tax exemption.

Except for imports of machinery and factory equipment, they must still use a notice of tax exemption as a condition for obtaining facilities.

Thus, the input tax on import or acquisition of taxable goods or services used to acquire these strategic goods cannot be credited.