Request for Tax Relaxation Can Be Done Via Online. Here's How To Do It

Monday, 06 April 2020

JAKARTA. Tax incentives for businesses in the manufacturing industry with certain Business Classifications (Klasifikasi Usaha KLU), affected by the Corona Virus Disease 2019 (Covid-19) outbreak, can be obtained by submitting an application or notification online, through the Directorate General of Taxes (DGT) online website (www.pajak.go.id).

As we know, the government has issued Regulation of the Minister of Finance (Peraturan Menteri Keuangan/PMK) number 23 / PMK.03 / 2020, regarding Tax Incentives for Taxpayers (Wajib Pajak/WP) affected by Corona virus. Some incentives provided include, Income Tax (PPh) Article 21 (ITA) 21 borne by the government, exemption from ITA 22 on import , reduction of ITA, and accelerated Value Added Tax (VAT) restitution.

Read: Responding Corona, Tax Stimulus Package is Officialy Valid

These are the following steps to get these facilities via online.

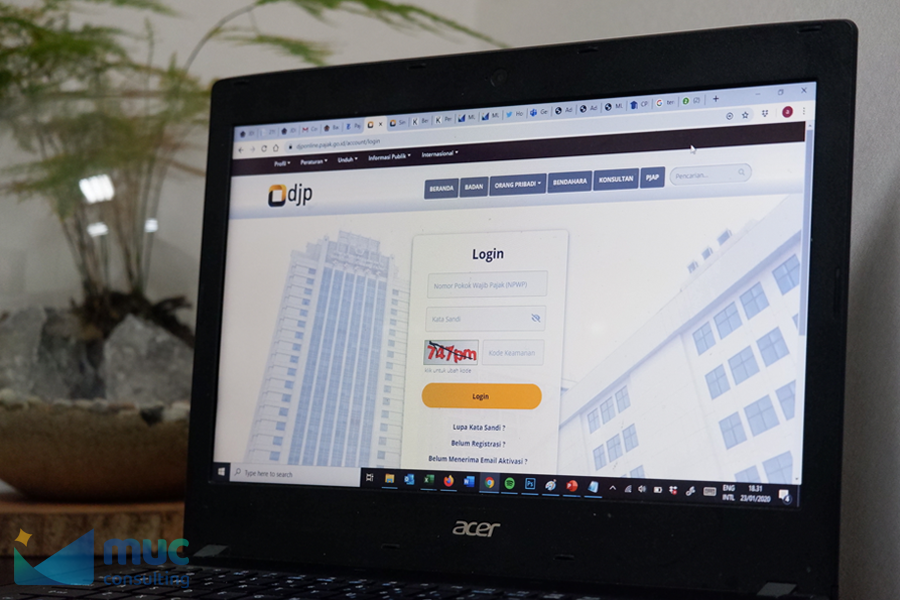

1. Visit the DGT website online (www.pajak.go.id)

2. login by entering Tax ID Number (Nomor Pokok Wajib Pajak/NPWP) and password.

3. Select the service tab then click the KSWP icon or Confirmation of Taxpayer Status ( Konfirmasi Status Wajib Pajak).

4. In the section of My Obligation Compliance Profile (Profil Pemenuhan Kewajiban Saya), select the type of incentive you want to use.

KLU Compability

As stated above, this facility is only given to WP in the manufacturing industry with certain KLU. Therefore, make sure that you have filled out the appropriate KLU type in the Annual Tax Return.

Since, to ensure that you are entitled to the facility, the DGT will determine the KLU based on the 2018 annual tax return filled by taxpayer. If, the type of KLU is not yet listed in the 2018 annual tax return, taxpayer must correct the annual tax return.

However, if taxpayer is also unable to make correction, for example because they are still undergoing a tax audit, taxpayer can submit data changes to the DGT. As for newly registered taxpayer after 1 January, 2019, the KLU code will be adjusted to the Registered Certificate (Surat Keterangan Terdaftar/SKT) issued by the Tax Office (Kantor Pelayanan Pajak/KPP).

Based on PMK number 23 / PMK.03 / 2020, ITA 21 facilities borne by the government will be provided for 440 KLU as attached in the regulation. While the exemption of ITA 22 on import, 30% reduction of ITA 25 and accelerated VAT refund will be given to manufacturing companies listed in attachment 102 KLU for incentive recipients. (ASP/Ken).