Rate Rises, Minister of Finance Releases List of 11 Transactions of Value Added Tax Object

MUC Tax Research Institute

|

Wednesday, 06 April 2022

The government confirmed the increase in the Value Added Tax (VAT) rate from 10% to 11% starting 1 April 2021, by issuing dozens of Minister of Finance Regulations. The new VAT rate will target certain types of transactions for the transfer of goods and/or services, ranging from fertilizers, cigarettes, and used motorcycles, to crypto assets.

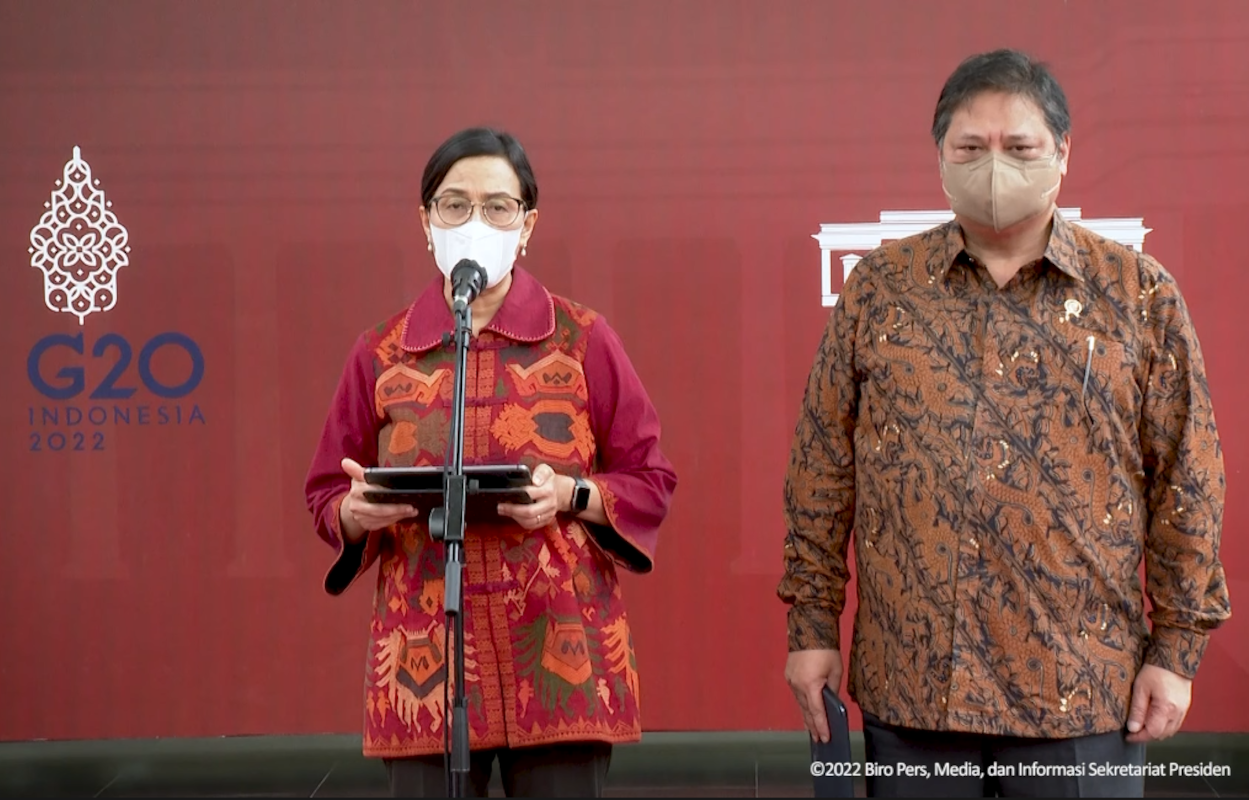

This affirmation by the Minister of Finance Sri Mulyani Indrawati is a mandate of the Harmonized Tax Law (HPP law), one of the clauses of which is to gradually increase the VAT rate starting 1 April 2022 to 11% and to 12% by the end of 2024.

The following is a list of transactions for the transfer of goods and/or services whose tax imposition schemes and tax reporting procedures are adjusted according to the new VAT rate policy:

- Procurement of goods and/or services through the Government Procurement Information System

- Utilization of intangible goods and/or services from outside the customs territory through trade through electronic systems

- Self-building activities

- Transfer of certain Liquid Petroleum Gas (LPG)

- Transfer of tobacco products

- Transfer of certain agricultural goods

- Transfer of used motor vehicles

- Transfer of subsidized fertilizers to the agricultural sector

- Transfer of insurance agent services, insurance brokerage services, and reinsurance brokerage services

- Crypto asset trading transactions

- Implementation of financial technology (Fintech)

The HPP Law also gives discretion to the government to change the VAT rate as long as it does not exceed the minimum limit of 5% and a maximum of 15%.

To change the VAT rate, the government only needs to issue a Government Regulation (PP) after it is approved by the House of Representatives (DPR), through the State Budget mechanism.

The following is a list of implementing regulations for the HPP Law related to the new VAT policy issued by the Minister of Finance:

- Minister Of Finance Regulation (PMK) Number 58/PMK.03/2022 on Appointment of Other Parties as Tax Collectors and Procedures for Tax Collection, Payment, and/or Reporting Collected by Other Parties on Transactions of Goods and/or Services Procurement through the Government Procurement Information System

- PMK Number 59/PMK.03/2022 on Amendment to PMK Number 231/PMK.03/2019 Regarding Procedures for Registration and Nullification of Taxpayer Identification Numbers, Confirmation and Confirmation on Revocation of VAT-Registered Persons, as well as Tax Withholding and/or Collection, Payment and Reporting for Government Institutions

- PMK Number 60/PMK.03/2022 on Procedures to Appoint Collector, Collection and Payment, and Reporting of Value Added Tax on the Use of Taxable Intangible Goods and/or Taxable Services from Outside of the Customs Territory in the Customs Territory through Trade using Electronic Systems

- PMK Number 61/PMK.03/2022 on Value Added Tax on Self-Building Activities

- PMK Number 62/PMK.03/2022 on Value Added Tax on the Transfer of Certain Liquefied Petroleum Gas

- PMK Number 63/PMK.03/2022 on Value Added Tax on Transfer of Tobacco Products

- PMK Number 64/PMK.03/2022 on Value Added Tax on the Transfer of Certain Agricultural Products

- PMK Number 65/PMK.03/2022 on Value Added Tax on the Transfer of Used Motor Vehicles

- PMK Number 66/PMK.03/2022 on Value Added Tax on the Transfer of Subsidized Fertilizers for Agriculture Sector

- PMK Number 67/PMK.03/2022 on Value Added Tax on the Transfer of Insurance Agency Services, Insurance Broker Services, and Reinsurance Broker Services

- PMK Number 68/PMK.03/2022 on Value Added Tax and Income Tax on Crypto Asset Trading Transactions

- PMK Number 69/PMK.03/2022 on Income Tax and Value Added Tax on the Implementation of Financial Technology

- PMK Number 70/PMK.03/2022 on Criteria and/or Details of Food and Beverages, Art and Entertainment Services, Hospitality Services, Parking lot Provision Services, as well as Catering Services, which are Not Subject to Value Added Tax

- PMK Number 71/PMK.03/2022 on Value Added Tax on the Transfer of Certain Taxable Services.

Jaringan Dokumentasi dan Informasi Hukum, Kementerian Keuangan