IRS Documents Leaked, Tax Avoidance Of The World's Richest People Uncovered

Wednesday, 09 June 2021

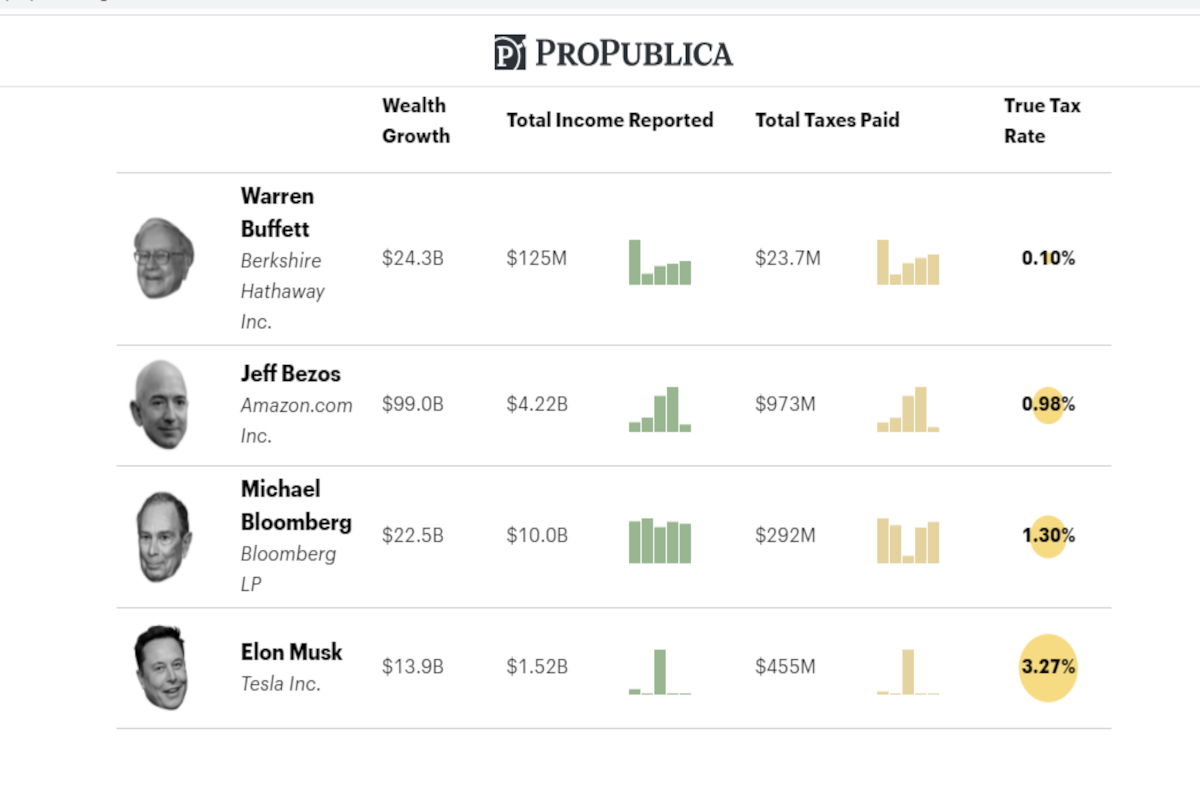

Leaked classified Documents of the Internal Revenue Service (IRS) reveal the tax avoidance practices of the 25 richest people of the US and even the world. Warren Buffet, Jeff Bezos, Elon Musk, George Soros, Bill Gates, Rupert Murdoch, Mark Zuckerberg, and Michael Bloomberg are on the list of billionaires who pay less tax than they should, or don't even pay taxes at all in a given period of time.

This fact was leaked by ProPublica, an independent and non-profit news agency focused on investigative journalism to investigate abuses of power by government officials, businesses, and other institutions.

In its investigative report, ProPublica assesses that the richest group of people in the US has so far succeeded in setting their own tax rates, ao that their taxes are lower than the taxes that they should or are imposed on workers in general.

Between 2014 and 2018, the collective wealth of the 25 richest people in America increased by USD 401 billion. However, on average they only pay federal income taxes of 3.4% or 6.6% less than the lowest income tax layer set by the US government.

Most of them take advantage of loopholes to avoid paying taxes at supposedly higher rates.

The world's richest man Jeff Bezos, for example, did not pay any taxes in 2007. The Amazon founder and CEO repeated the same thing in 2011.

Likewise, the founder of Tesla who is the second richest person in the world, Elon Musk, revealed by ProPublica, the tax value he paid in 2018 was USD 0.

It's no different with Michael Bloomberg who has also managed to do the same thing in recent years.

Then, billionaire investor Carl Icahn managed to avoid paying taxes twice. Meanwhile, George Soros has not paid income tax for three consecutive years.

Currently, in the US the income of labor is taxed at a higher rate than the tax imposed on the capital and business income of corporations.

In recent years, the average American household earns about USD 70,000 a year and pays 14% federal taxes. Starting this year, the highest income tax rate in the US is 37% for couples earning over USD 628,300.

ProPublica